The $5 billion fine Facebook agreed to pay to the Federal Trade Communications in a settlement over privacy issues had no bearing on the company’s second-quarter financial results, which were reported earlier this week.

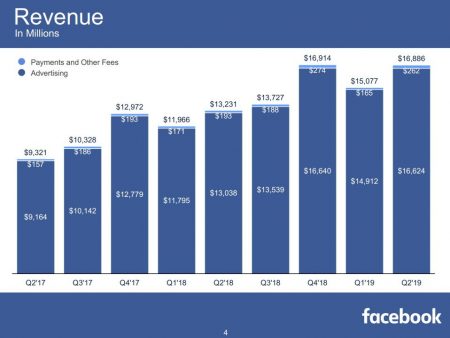

Facebook reported revenue of $16.886 billion, up 28% from $13.231 billion in the second quarter of 2018. Nearly all of that revenue—$16.624 billion—came from advertising.

Chief financial officer David Wehner said in his opening remarks during Facebook’s earnings call that in terms of regional ad revenue growth, North America and the Asia-Pacific region led at 30% apiece, followed by Europe at 21% and rest of world at 21%, adding that the latter was impacted by currency headwinds.

The company’s net income fell 49% year-over-year, to $2.616

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in