Mark your calendar for Mediaweek, October 29-30 in New York City. We’ll unpack the biggest shifts shaping the future of media—from tv to retail media to tech—and how marketers can prep to stay ahead. Register with early-bird rates before sale ends!

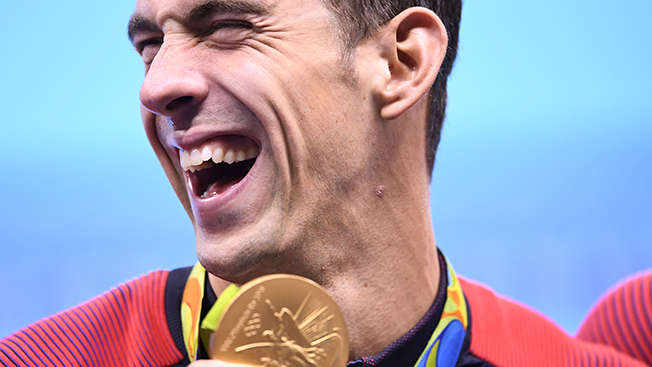

The television ad market in 2016 saw a 4.4 percent revenue increase over 2015 thanks to the Summer Olympics and the election, according to new data from Standard Media Index.

Broadcast revenue jumped 4.6 percent, while cable was up 4 percent. But when sports-related revenue, which increased 16 percent due to the Rio Olympics, is excluded from the tally, TV was only up 1.4 percent. (Cable grew 3.9 percent, while broadcast was down 2.4 percent.) The elections also boosted last year's ad revenue, driving the news genre to a 14.1

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in