Mark your calendar for Mediaweek, October 29-30 in New York City. We’ll unpack the biggest shifts shaping the future of media—from tv to retail media to tech—and how marketers can prep to stay ahead. Register with early-bird rates before sale ends!

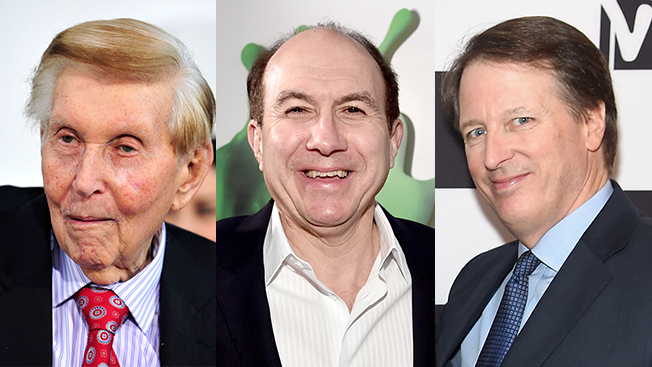

As Hollywood-related civil wars go this summer, Captain America and Iron Man have got nothing on Sumner Redstone and Philippe Dauman, who are engaged in a public, bitter battle over the future of Viacom.

With Team Redstone (the company's founder, who stepped down as executive chairman in February) and Team Dauman (Viacom's CEO, who replaced Redstone as chairman) trading public statements and lawsuits, ad buyers who are preparing for upfront negotiations with the company are surveying the chaos from afar and choosing to side with a third camp: Team Lucas.

That's Jeff Lucas, head of marketing and partner solutions for Viacom, and the person who will be overseeing the upfront business across Viacom's portfolio.

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in