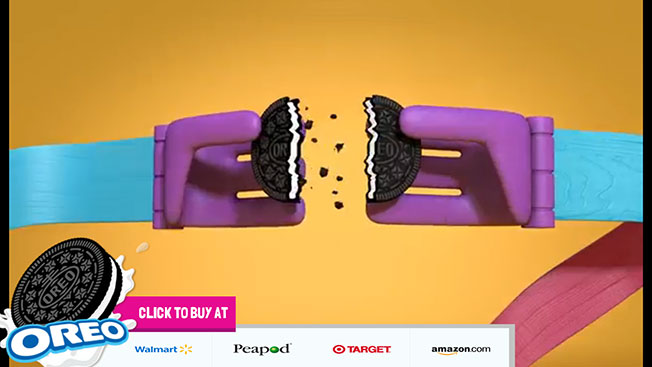

Mondelez International—the makers of Oreo cookies, Cadbury chocolate and Trident gum, among other treats—quietly started becoming an e-commerce brand with a a small test in Europe earlier this year. Now, Mondelez plans to convert all its digital media in 25 countries into shoppable ads with "buy now" buttons to drive sales through retailers like Walmart and Amazon.

The goal is to double Mondelez's online revenue over the next couple of years, particularly on social media where millennials are spending a substantial amount of time.

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in