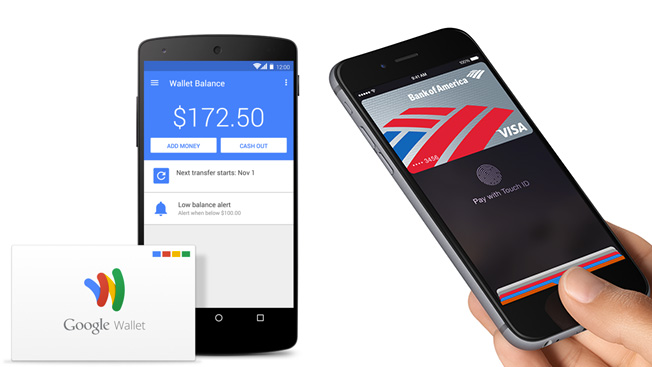

During this week's Mobile World Congress in Spain, Google announced it is getting into mobile payments with a technology called Android Pay that lets people buy things by tapping their phones at cash registers in stores.

While the move is interesting and long awaited for mobile marketers, the reality is most people have no clue how mobile payments work or what they actually do.

Broadly speaking, mobile payments power the technology inside your phone so you can check out either online or in a store.

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in