Google wants to prove to advertisers that there's a direct correlation between someone seeing a search ad and then going into a brick-and-mortar store.

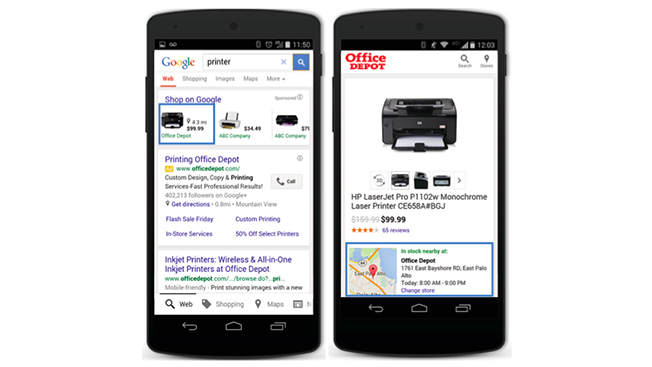

The tech giant is rolling out a new tool today called "store visits" that gives marketers some insight into which types of search ads—which include local inventory and product listings ads—motivate people to go to a store.

Google's store visits tool uses an algorithm to estimate how many people went into a store as a result of seeing an ad within 30 days.

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in