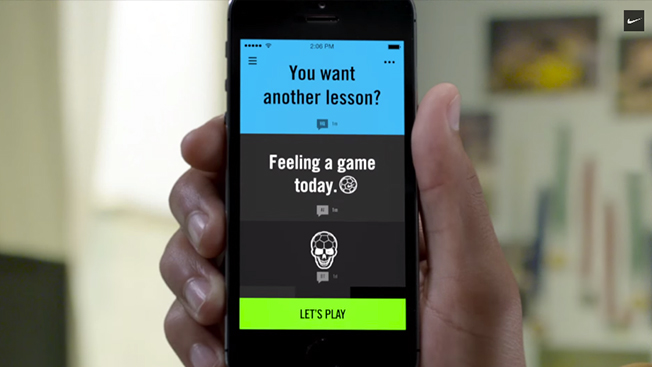

A new set of investments from big-name brands Nike, The North Face and Tory Burch are bringing some much-needed utility and appeal to mobile apps that keep them afloat.

Once considered the primary (and often uneffective) way for brands to get into mobile, brands are now applying better types of content and data to fitness apps. And as more marketers look for ways to experiment with connected devices, brands are also looking to piggyback on the success of health trackers like Jawbone and FitBit to reach wider groups of consumers.

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in