Snapchat Is Well-Positioned for Its IPO, With One Caveat

The company may never be profitable

Snapchat is growing up and seems well-positioned for an initial public offering. A pair of reports from Verto Analytics gives insight into the messaging application’s near future by examining time spent on Snapchat, along with U.K. demographic data.

In the past, Snapchat has been criticized for its lack of transparency regarding user data. But with the IPO on the horizon, CEO Evan Spiegel is focused more on provable, hard metrics, including the time users spend in the app.

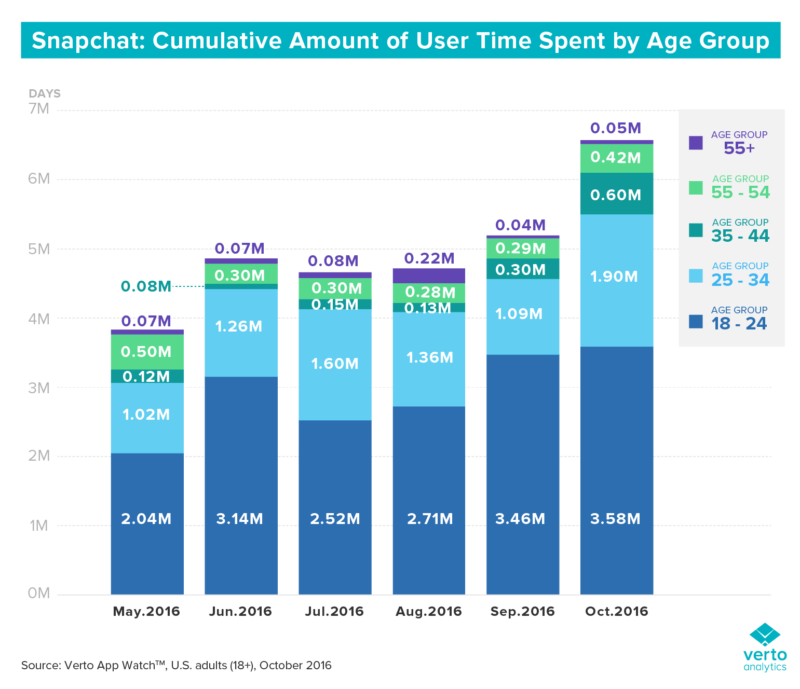

While it’s no surprise that 18- through 24-year-olds are the biggest group using Snapchat, the time they spend on the app is a little more of a surprise.

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in