Mark your calendar for Mediaweek, October 29-30 in New York City. We’ll unpack the biggest shifts shaping the future of media—from tv to retail media to tech—and how marketers can prep to stay ahead. Register with early-bird rates before sale ends!

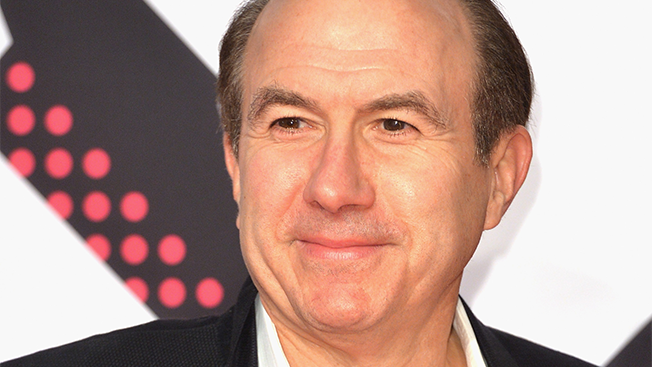

In his first public comments since his public battle with Viacom founder and chairman emeritus Sumner Redstone over the company's future, Viacom executive chairman and CEO Philippe Dauman said the company is staying focused on business and has already completed half of its upfront sales.

Dauman, who spoke today at the Gabelli & Company Movie & Entertainment Conference in New York, said that he's not relishing his moment under the microscope. On May 20, the 92-year-old Redstone removed him and George Abrams from the seven-person trust that will control Viacom (and CBS Corp.)

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in