Mark your calendar for Mediaweek, October 29-30 in New York City. We’ll unpack the biggest shifts shaping the future of media—from tv to retail media to tech—and how marketers can prep to stay ahead. Register with early-bird rates before sale ends!

The merger of CBS and Viacom, which seemed like a foregone conclusion for much of the year, is instead on hold—perhaps permanently.

This morning, National Amusements, which owns 80 percent of the voting shares of both Viacom and CBS, announced it had asked the CBS and Viacom boards to cease their discussions of a potential merger "and focus instead on their independent paths forward."

UPDATE: Monday afternoon, Viacom announced that Bob Bakish, who had been serving as acting president CEO and president since Nov. 15, has been named permanent CEO in light of the CBS-Viacom decision.

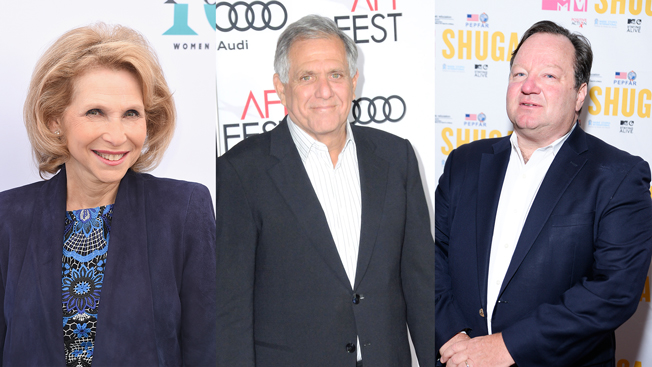

In a letter sent to both boards from National Amusements CEO Sumner Redstone and his daughter Shari, who is vice chair, the two stated that, "over the past few months, after carefully assessment and meetings with the leader of both companies, we have concluded that this is not the right time to merge the companies. Following the management changes that the Viacom Board put in place, we have been very impressed with the forward-looking thinking and strategic plan being pursued under Bob Bakish's leadership."

The letter continued, "We know Viacom has tremendous assets that are currently undervalued, and we are confident that with this new strong management team, the value of these assets can be unleashed. At the same time, CBS continues to perform exceptionally well under Les Moonves, and we have every reason to believe that momentum will continue on a stand-alone basis."

The surprising news comes two and a half months after National Amusements officially asked CBS and Viacom to consider a merger. The companies initially split a decade ago.

At the time, the Redstones said, "We believe that a combination of CBS and Viacom might offer substantial synergies that would allow the combined company to respond even more aggressively and effectively to the challenges of the changing entertainment and media landscape."

National Amusements said it wouldn't accept or support a third party acquiring either company, nor any deal under which it would not control the merged company.

A merger between CBS and Viacom had been expected since Redstone prevailed over former Viacom president and CEO Philippe Dauman, after months of fighting over the future of Viacom. That battle began in February, when Dauman was named executive chairman of Viacom, over Shari's objections. The parties finally settled their differences in August, and Dauman agreed to depart as president and CEO of Viacom.

The 93-year-old Redstone remained with Viacom as chairman emeritus, while his daughter Shari stayed on as nonexecutive vice chair. COO Tom Dooley was named acting president and CEO of Viacom at the time, but he departed the company last month, with Bob Bakish taking over.

Many analysts and investors said this year that the beleaguered Viacom's best path to success would have been via a CBS merger, with CBS Corp. chairman and CEO Leslie Moonves expected to run both companies.

In his public statements since the CBS/Viacom talks were announced in September, Moonves had stressed that discussions were in their early stages and the outcome was unclear.

"We are very happy the way we are as a standalone company," but "anything could happen," said Moonves, speaking last week at the UBS Global Media and Communications Conference in New York.

Moonves praised the early moves by Viacom's Bakish as "pretty positive," and said Viacom might ultimately find it in its best interest to continue operate independently.

During last month's CBS earnings call, Moonves reiterated, "we will only do a deal if it's in the best interest of CBS and all of its shareholders."

Meanwhile, Viacom's execs have said publicly this fall that they had been directed to operate under the assumption that the company would remain independent.