Mark your calendar for Mediaweek, October 29-30 in New York City. We’ll unpack the biggest shifts shaping the future of media—from tv to retail media to tech—and how marketers can prep to stay ahead. Register with early-bird rates before sale ends!

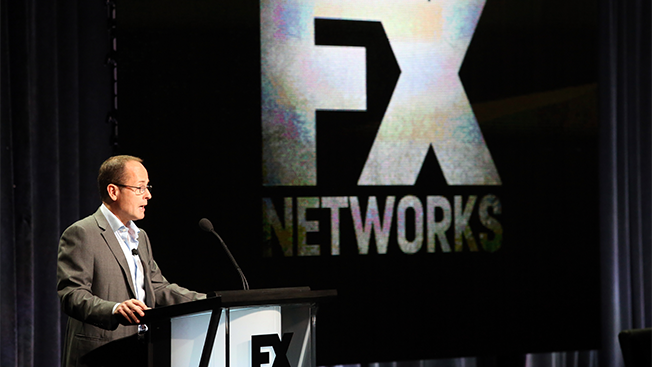

Five months after he coined the term "peak TV" to describe the overwhelming amount of video content available to audiences, FX Networks CEO John Landgraf said we're not yet at the peak, but will be soon. Landgraf also renewed his calls for Netflix to release data so it can be on a level playing field with the other TV networks.

FX released data last month which indicated that a record 209 scripted series aired in 2015. Landgraf

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in