If trends among millennials are any indication, cash, checks and credit cards could all be going the way of the passenger pigeon.

As Bloomberg points out, mobile payment apps like eBay's Venmo are increasingly being used by young adults to handle everything from dining tabs to living expenses. Usage of the app jumped 62 percent during this year's first quarter, with a total of $312 million in processed transactions.

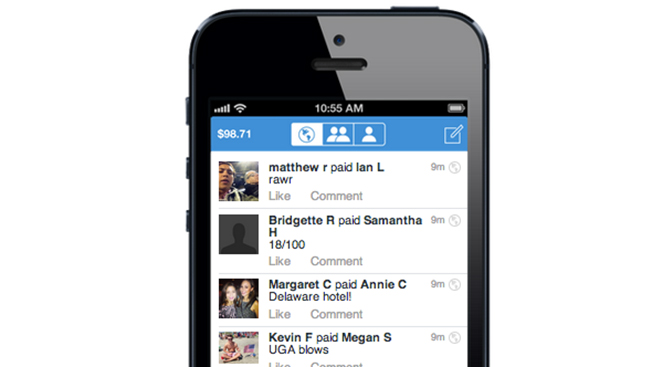

Payment apps, which link to a user's checking and credit accounts, can be downloaded for iOS and Android phones and accessed with Wi-Fi at restaurants and bars.

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in