Luxury brands are often singled out as slow adopters when it comes to digital, primarily because there’s still reluctance from consumers to buy high-ticket items online. However, marketers for L’Oreal-owned Lancôme offered data results to Adweek that suggest that it would behoove marketers in this category to focus more on cross-channel shopping to build loyalty programs instead of worrying only about e-commerce.

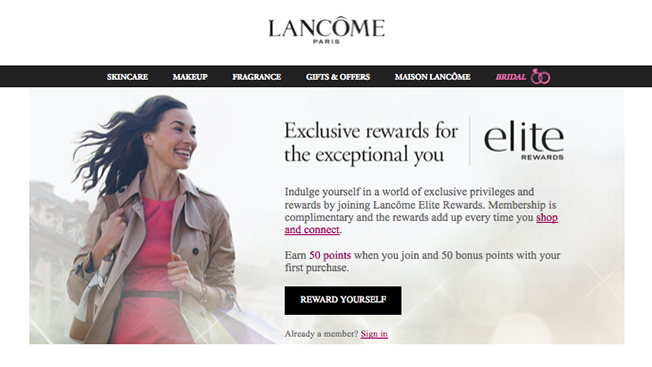

Lancôme rolled out its Elite Rewards loyalty program on April 1, which is powered by CrowdTwist.

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in