Be among trailblazing marketing pros at Brandweek this September 23–26 in Phoenix, Arizona. Experience incredible networking, insightful sessions and a boost of inspiration at ADWEEK’s ultimate brand event. Register by May 13 to save 35%.

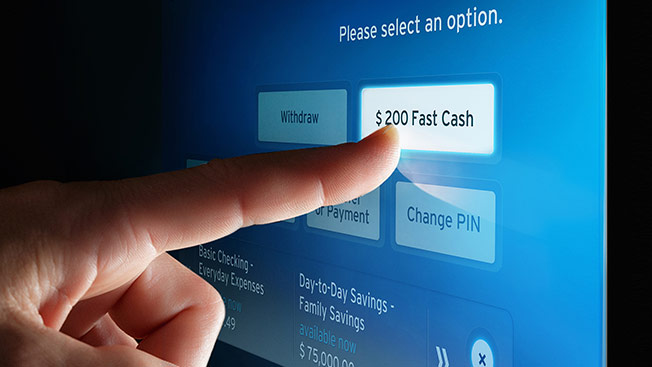

Citi is straining to break ahead of the financial services pack with user-friendly digital tools aimed at making banking with Citi as easy as shopping with Amazon. The bank chain is rolling out upgraded customer-centric ATMs in the U.S. this month and on Feb. 3 launched a revamped mobile app that lets you check your balances with a tap.

Citi and rivals Chase, Bank of America, Wells Fargo and American Express face difficulties related to lingering consumer distrust from the 2008 financial crisis and the growth of nimble online companies like Ally Bank that use ads to chide big banks for fees and service issues.

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in