Mark your calendar for Mediaweek, October 29-30 in New York City. We’ll unpack the biggest shifts shaping the future of media—from tv to retail media to tech—and how marketers can prep to stay ahead. Register with early-bird rates before sale ends!

When it comes to late-night dominance among advertisers, Jon Stewart and Stephen Colbert were the clear winners in recent years. But starting next week, it will likely all come down to Colbert and Jimmy Fallon.

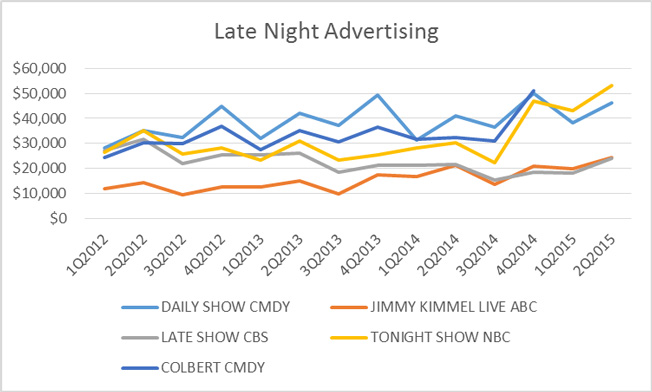

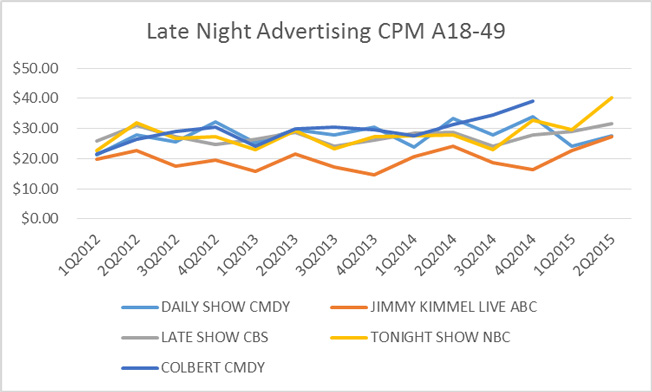

That's according to advertising cost provider SQAD NetCosts, which tracked quarterly 30-second ad costs and CPMs for adults ages 18 to 49 for the three 11:30 p.m. late-night shows on broadcast TV, along with The Daily Show and The Colbert Report, going back to 2012.

The Daily Show with Jon Stewart and The Colbert Report's advertising reign during most of that time—until Colbert signed off last December—reflects the Comedy Central shows' younger demographics compared with their broadcast competitors, as well as the appeal of Stewart and Colbert's shows "to inform as well as entertain," said Dan Klar, vp of product development for SQAD.

In former Late Show host David Letterman, who stepped down in May, and former Tonight...

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in