Mark your calendar for Mediaweek, October 29-30 in New York City. We’ll unpack the biggest shifts shaping the future of media—from tv to retail media to tech—and how marketers can prep to stay ahead. Register with early-bird rates before sale ends!

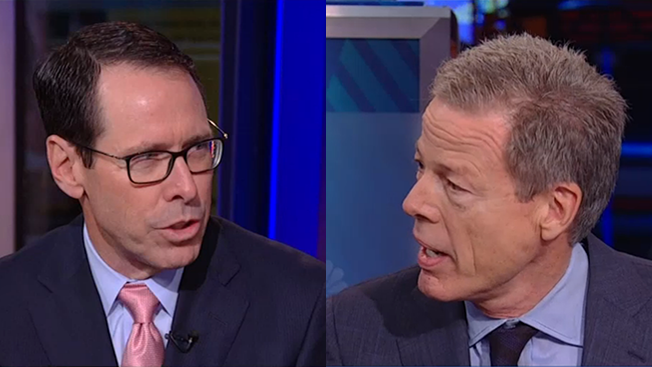

After a whirlwind weekend in which AT&T announced its $85 billion deal to acquire Time Warner, the companies' two CEO sat down to explain what it all means.

In the megamerger, the telecommunications powerhouse will buy Time Warner for $107.50 per share, or about $85 billion, half in stock, half in cash. The new behemoth will combine Time Warner's hefty film and TV properties (including Warner Bros., HBO, TNT, TBS and CNN) and AT&T's robust broadband (U-Verse), wireless (AT&T) and satellite (DirecTV) offerings.

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in