Achieving ‘Mainstream Green’ is key to a more sustainable economy. Read the new report on the CMO Sustainability Accelerator hub to learn more and take action.

At the height of rationing during World War II when many families were struggling to put a meal on the table, sales of lipstick spiked. More recently, as Hurricane Katrina was bearing down on the coast of Florida, there was a rush on Pop-Tarts and beer at local Walmarts. When forced to make tough decisions, people make odd choices.

There’s some method to the madness here that may help explain which companies will survive this pandemic. So far retail, travel and hospitality have been hit hard while food delivery, alcohol and porn are going wild. But what about companies that operate within the same industry? You’d expect their performance to be the same but weirdly, that’s not the case.

Take clothing, for example. Between Valentine’s Day and today—three months—Gap lost almost 60% of its value while H&M lost half of that. Or cars: Ford, GM and Chrysler are down 35%-40% while Tesla is worth the same as it was before Covid. Burger King and McDonald’s are down 20% while Chipotle has escaped unscathed.

Those with low debt and easy access to capital are doing better, unsurprisingly, as are those who sell online. But cash is a Band-Aid, and ecommerce alone cannot make up for a lack of demand.

Do your customers give a damn about whether your company lives or dies?

“No” is the answer that many CEOs are waking up to today. JCPenney, J.Crew, Neiman Marcus, Modell’s Sporting Goods—the list of bankruptcies this year in the retail sector alone is breathtaking, and there are many more to come. Will your company be one of them?

The answer to that question depends on how much your customers value you. At the risk of oversimplification, there are three ways to think about this:

I need coffee, not an inspirational quote

Uber and Lyft have spent hundreds of millions of dollars over the past decade (money that they could sorely use right now) trying to explain their existential philosophy. I don’t care; I use them because they are cheaper, faster and more reliable than taxis. I use them interchangeably, and I can’t tell them apart when I’m using them, which is the very definition of a commodity.

The same is true of airlines. I’ve come to dread the first few minutes after boarding, not because I’m scared of flying but because I’m scared I’ll be forced to watch yet another airline CEO explaining his philosophy accompanied by a rousing yet unmemorable piano soundtrack.

I’ve yet to meet a CEO who thinks they work in a nonaspirational category. It feels good to be told that you are selling individual self-empowerment, not laundry detergent.

This approach works for some companies. Rapha makes a small fortune luring in middle-aged men in lycra with their minimalist London aesthetic. Glossier had millennial women queuing around the block last year for cheap skincare because they felt part of its community.

Community, heritage, design, beliefs: These things work when you’re selling alcohol, luxury goods, cars and clothing because the purchases are social in nature. When I buy a pair of sneakers or order a drink at a bar, it says something about who I am.

Harder, better, faster, stronger

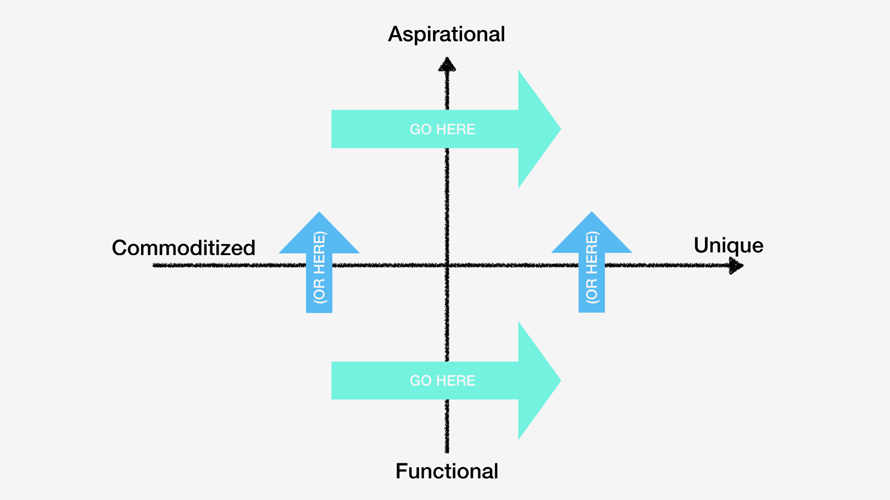

When you use Kleenex toilet tissue, on the other hand, it’s unlikely that you are trying to make a philosophical statement. CPG brands like Kleenex are more about the what than the why; they live in the bottom half of the chart. The only credible way for them to increase their value is to move to the right.

This is easier said than done. CEOs tend to overestimate how unique they are. Remember when Netflix tried to put its prices up back in 2011? It lost 800,000 subscribers almost overnight and its stock price dropped 77% in four months. Gap stock is now worth $7 (it was once worth $45) because there is nothing new or disruptive in what they sell, and as a result, they are forced to put the whole store on sale every day.

The rash of failed IPOs last year followed by the battering of Covid-19 has sounded the alarm that many of the new unicorns are not as differentiated—or valuable—as they once thought they were. If all this leaves you staring despondently at the bottom left quadrant, don’t worry; you’re in good company. Two of the six biggest companies in the world—PetroChina and Saudi Aramco—live in this quadrant.

Unless you work in the petrochemical industry, however, it’s somewhat unlikely that you live permanently in the bottom left quadrant. Most companies are able to find something other than price to distinguish themselves. A new wave of direct-to-consumer companies has turned entire industries on their heads by promising to make life functionally easier, faster and more affordable. It’s what performance, comfort and safety are to the car industry. Everybody’s using the same script.

Which brings us to personalization, the holy grail of differentiation. The promise of offering something as unique as each customer is proving irresistible and sweeping away industries from clothing to vitamins to music and even burgers.

Up and to the left

Most companies have a binary choice to make here. In order to increase their brand value, they either move up or move to the right; very few get to do both. These chosen few are uniquely aspirational and profitable. Most crucially, their customers are loyal.

It takes time to build and consistently maintain brand loyalty, which is notoriously difficult to measure. Companies born in the last decade tend to fixate on acquisition instead, for the simple reason that it’s an easier sell to venture capitalists. In purely economic terms, however, this is a mistake.

Improving customer retention by 10% is better than improving CPA by 10% because it’s (mostly) free. All it requires is a focus. And focus, I’m sure we can all agree, is the one thing that Covid-19 has provided us.