In the world of high fashion, the most important models aren’t the ones sauntering down the catwalks—they’re the statistical models used to drive decision-making.

Smart apparel retailers are turning to big data and analytics to give them a leg up in a market that is in the midst of enormous disruption. Sales at big-name department stores and major mall outlets are falling. Instead, consumers are turning to discounters, making online buys from pure ecommerce shops such as Zulilly and Zappos or subscribing to custom-fit subscription services such as Stitch Fix, Trunk Club and LeTote.

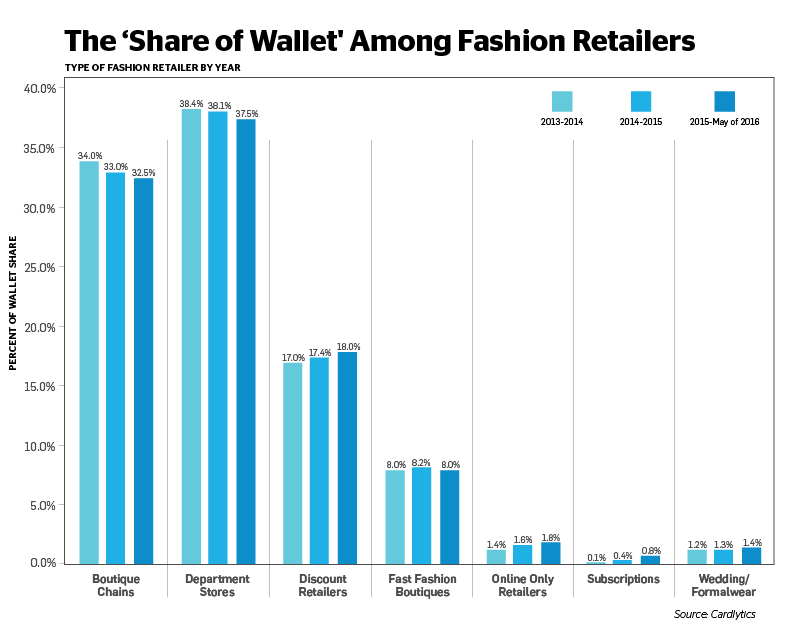

According to data from Cardlytics (based on purchases of 120 million consumers), shoppers—and in particular millennials—are increasingly fickle. They may be abandoning traditional stores, but they’re open to a broader menu of shopping experiences. They like to shop 24/7, they appreciate good deals and they prefer more personalized service. In this category, one size definitely does not fit all.

Retailers who are succeeding in this challenging environment are using data in creative ways to react quickly to trends and make better decisions.

Berlin-based Lesara collects data from myriad sources—Google trends, social media, even fashion bloggers—as well as its own web analytics and inventory management systems, says CEO Roman Kirsch. The online-only retailer then uses this data to inform its buying decisions.

“Last year we came across a blogger wearing LED sneakers and knew right away that this was a product with huge potential,” says Kirsch. “We had it online only a week later… offering the product before everybody else did. Those sneakers immediately became one of our best sellers, leading us to broaden the range to more than 20 different styles, which are all still selling hundreds of times a day.”

Stage Stores, which operates more than 800 retail outlets in 38 states (under the Bealls, Palais Royal, Peebles, Stage and Goody’s names), has been using predictive analytics to decide when to lower prices on aging merchandise and optimize its clothing inventory for size across different geographical areas. Using big data, Stage learned that marking down prices gradually during the middle of a season generates significantly more revenue than an “everything must go” sale when the season is over.

Stage has also been looking at using customers’ purchase histories and the buying habits of similar shoppers to allow floor personnel to make on-the-spot recommendations for accessories shoppers might also like. That’s a common staple of ecommerce, but still rare for brick-and-mortar.

Bottom line: Sales during last year’s holiday season increased nearly 7 percent year over year.

Stitch Fix, an online service that provides personal shopping consultants to its subscribers, also employs 60 data scientists and uses artificial intelligence to narrow the range of choices its stylists must face.

Using machine learning, Stitch Fix can identify the styles, colors and fabrics each shopper prefers. The company’s algorithms can even scan a customer’s Pinterest boards to get a feel for the kinds of clothes she likes. It presents that information to its stylists, along with her budget, measurements and any upcoming events she might be shopping for. Stitch Fix then aggregates this data to drive decisions about what kind of inventory to acquire.

“Our business is getting relevant things into the hands of our customers,” chief algorithm officer Eric Colson told Computerworld earlier this year. “We couldn’t do this with machines alone. We couldn’t do this with humans alone. We’re just trying to get them to combine their powers.”

When a fashion retailer employs a chief algorithm officer, you know times have changed.

Arlo Laitin, senior vice president of Ad Partnerships at Cardlytics, agrees. “Even with brands’ heavy investments in CRM, many still have a blind spot about what their customers do when they leave the store. With our purchase insights, marketers get a ‘whole-wallet’ view, so they can target their campaigns to consumers most likely to buy.”

By using a whole-wallet view and data strategically, retailers can make better buying decisions, leading to fewer markdowns and less inventory being offloaded at cost to discounters. They lose fewer sales and have happier customers who are more likely to come back a second time. That’s why, no matter what the season, big data will always be in style.