Millennials have a reputation for favoring borrowing over buying—they'd rather rent homes and lease cars than take on mortgages or car loans. Now, members of the borrower generation say they're straying from the largest likely lender: banks.

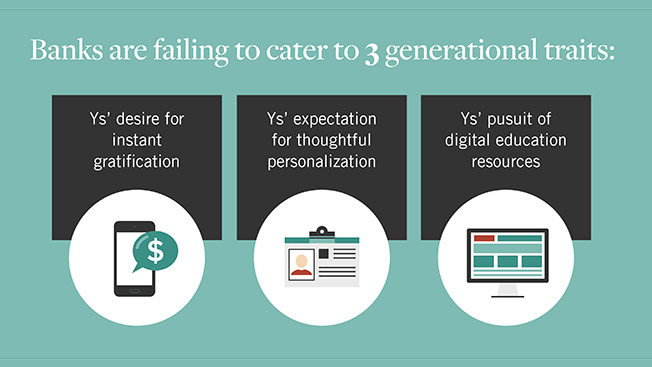

A new national survey of 1,500 millennials found that the majority don't believe large financial institutions are designed to serve them and would rather borrow money from friends or family. The Gen Y set doesn't believe banks are giving them the instant gratification via mobile options, digital-educational resources and personalization they desire.

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in