Inspiration meets innovation at Brandweek, the ultimate marketing experience. Join industry luminaries, rising talent and strategic experts in Phoenix, Arizona this September 23–26 to assess challenges, develop solutions and create new pathways for growth. Register early to save.

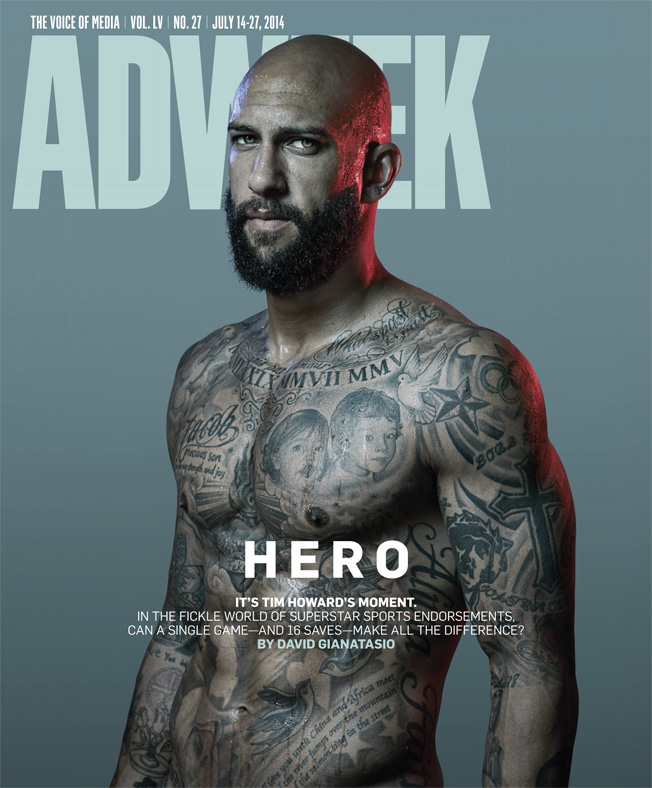

Following his gutsy performance for Team USA in the FIFA World Cup, goalkeeper Tim Howard is preparing for a big score.

The 35-year-old American, who also plays for Everton in England, became a media darling in the wake of America’s July 1 knockout-round loss to Belgium. Now, he’s looking to cash in on his newfound celebrity and break into the elite endorsement leagues. (He currently has six-figure deals with Nike and McDonald’s, making him a small fry in the rarified world of big-time sponsorships.)

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in