Inspiration meets innovation at Brandweek, the ultimate marketing experience. Join industry luminaries, rising talent and strategic experts in Phoenix, Arizona this September 23–26 to assess challenges, develop solutions and create new pathways for growth. Register early to save.

Behind the headlines of Alibaba’s $231 billion IPO are some interesting questions about how Alibaba’s direct-to-consumer approach to online shopping will fit into the U.S. online retail market.

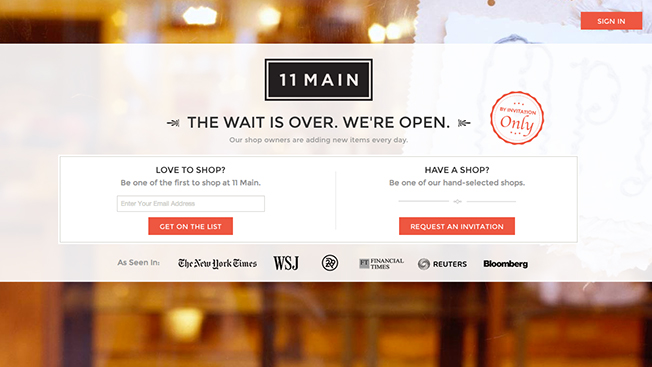

That strategy may work in China, where shoppers are willing to sift through thousands of products to find the best bargain, but in America, most people have never heard of Alibaba, according to Reuters. Also, American shoppers like to do their online spending in well-branded storefronts with names they trust.

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in