Inspiration meets innovation at Brandweek, the ultimate marketing experience. Join industry luminaries, rising talent and strategic experts in Phoenix, Arizona this September 23–26 to assess challenges, develop solutions and create new pathways for growth. Register early to save.

Could an Apple-Alibaba alliance be in the works? The two formidable tech companies have started a well-choreographed dance around Apple's new mobile payment system, Apple Pay, which some big retail chains in the U.S. are snubbing.

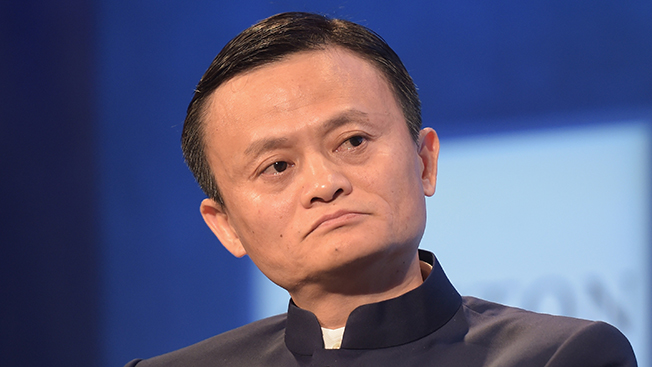

Jack Ma, the billionaire who founded China's massive online store Alibaba, on Monday said he's open to bringing Apple Pay to the Chinese market, Reuters reported. "I hope we can do something together," he said at a Wall Street Journal digital conference in California.

WORK SMARTER - LEARN, GROW AND BE INSPIRED.

Subscribe today!

To Read the Full Story Become an Adweek+ Subscriber

Already a member? Sign in